We have seen a convergence after years of cheap money, lots of liquidity, and companies pilling on debt loads that is now converging with a bankruptcy predictor called the “Z Score”. This is creating a blinking yellow light according to legendary bankruptcy expert Dr. Edward Altman.

As these two interlocked factors start to create warnings a third element is drifting into the not so distant future. An Article in the WSJ June 26, 2017, “The $1.5 Trillion Business Change Flying Under the Radar”. Congress is kicking around scrapping the interest deduction for businesses. This would increase the after tax cost of interest an additional 35% and may in fact put many highly leveraged deals in covenant default, to negative cash flows. The economic disruption would be gigantic.

With congress just thinking in those terms should send boards and executives thinking about alternative long term strategies.

Per Altman –

- “The average Z-score today is lower than it was in 2007, and 2007 was right before the great financial crisis, and of course, in ’08 and ’09 we saw a tremendous increase in corporate bond defaults and loans.

- He added: ‘So the good news is that it’s no worse, but the bad news is, fundamentally, the companies are no better than they were back in 2007 at least by our model.’

- At the moment what’s keeping companies from going bankrupt as they did during the financial crisis is the incredible amount of liquidity and low interest rates.

We’ll see how long that lasts.”

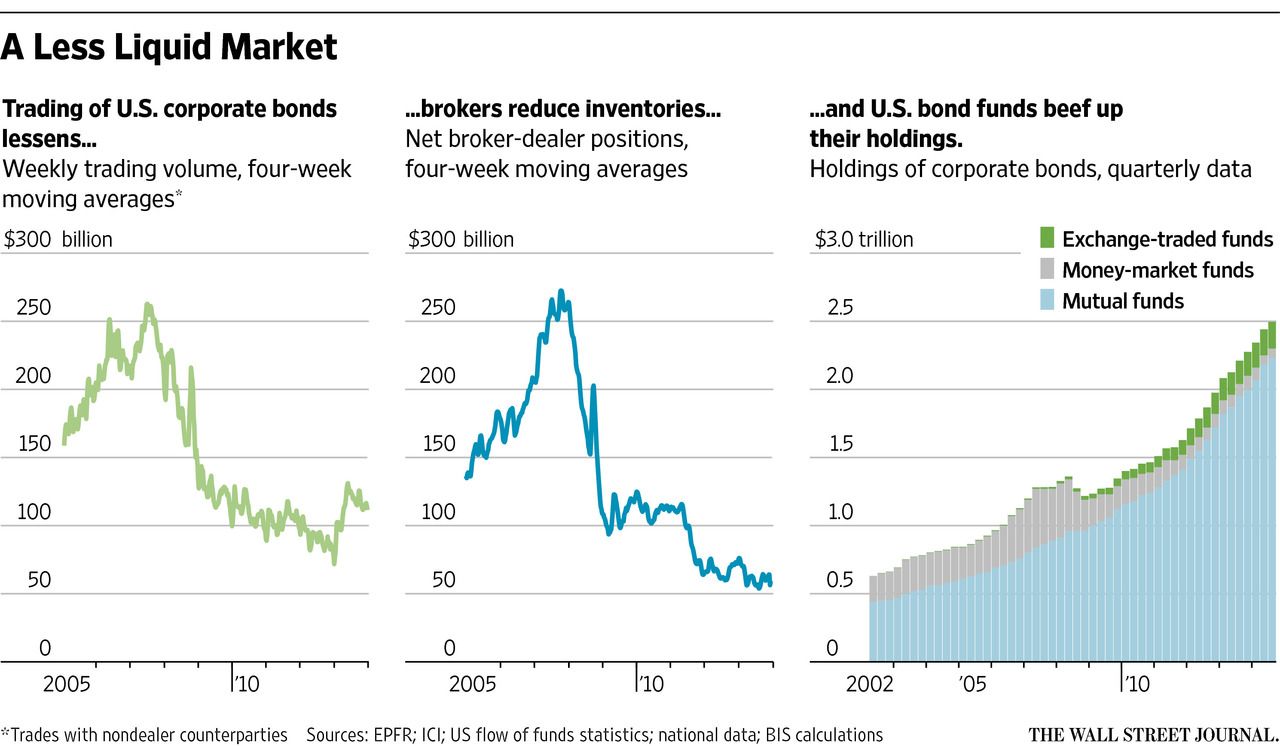

Contraction of Liquidity plus increased rates

The FED is reducing its balance sheet and pushing rates. Reducing liquidity may at some point push rates higher putting stress on highly leveraged deals. A lot of money has gone into junk bonds as investors sought higher returns. The impact of reduced liquidity and increased rates may start to impair M & A activity and put pressure on some thin highly leveraged deals. This is worth keeping a close eye on.

Summary

The 2007 financial crisis as we all know was mortgage induced not corporate debt induced so let’s not go negative on this. What is more concerning is the long term implications of a tax change on the interest deduction.

Leave A Comment